KYC Verification with Biometrics

AML & eKYC with biometric ID ownership validation

ID ownership validation is one of the two mandatory requirements of a legal digital KYC verification that binds an individual to his e-identity by preventing spoofing and from using a stolen identity. ID ownership validation is an essential component for most online financial transactions to be compliant with KYC/AML regulations.

Benefits of Digital KYC with Biometrics

Cost Effective:

Identification without the need for an additional employee doing the check

User Experience:

24/7 self-service identity proofing

Fraud Prevention:

Secure liveness detection and highly accurate ID photo matching

With BioID PhotoVerify, automated KYC & AML implementations are equivalent

to a „face-to-face“ Level of Assurance (LoA)

Trusted AML & KYC Secured with Biometric

Identity Authentication

The Know Your Customer guidelines have been introduced to prevent financial institutions from being used for money laundering. The legally required process must acquire and validate information with high trust levels. As such, digital KYC processes are costly for service providers (e.g. banks) and cumbersome for customers.

ID verification provided by BioID automates the process with biometrics while raising trust levels at the same time.

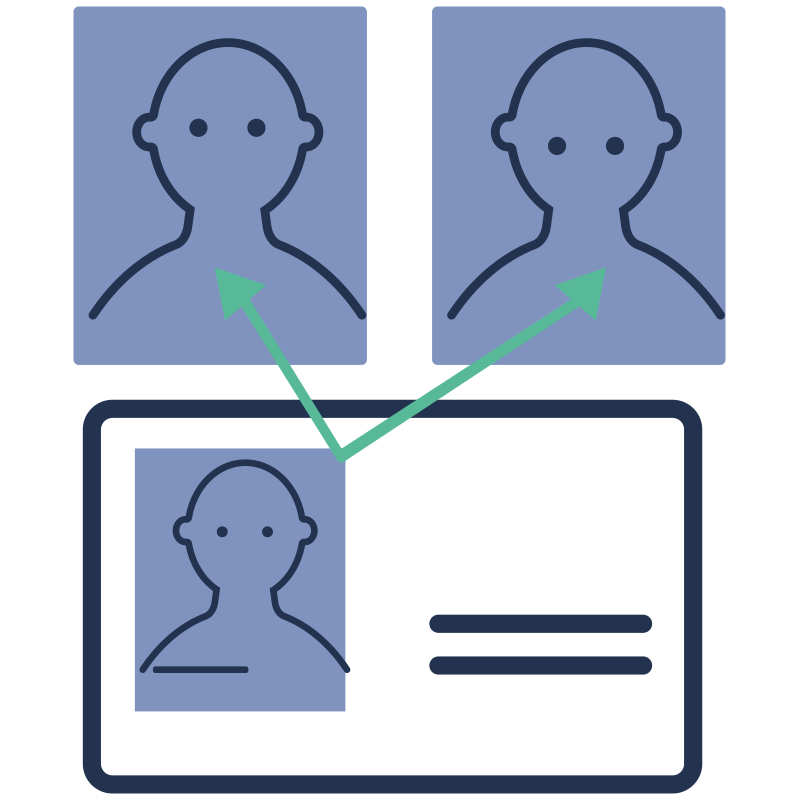

How PhotoVerify Performs ID Ownership Validation

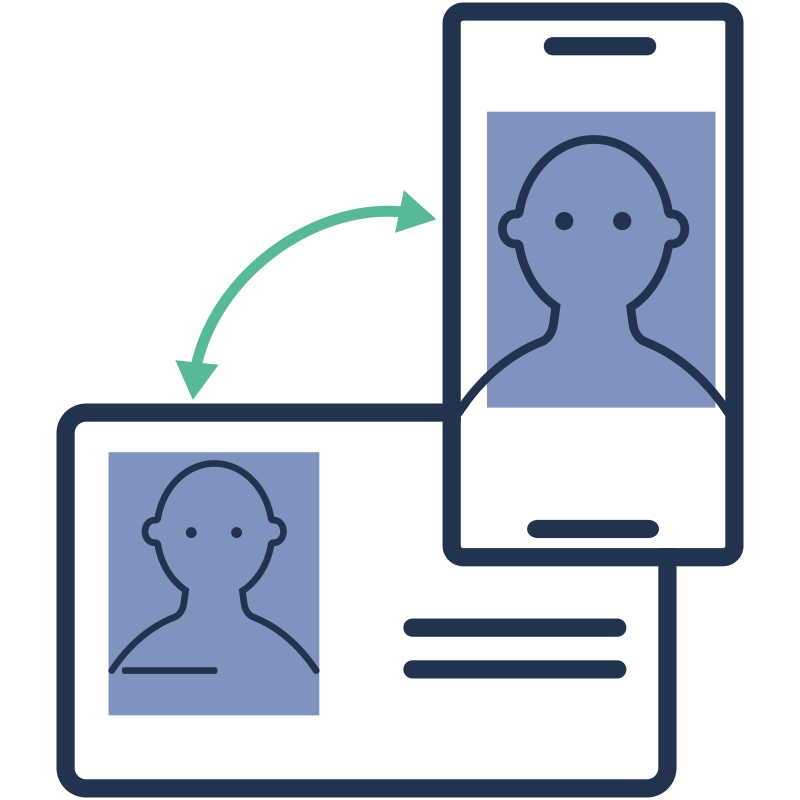

For a KYC ID ownership validation process, our PhotoVerify technology matches the image on an ID with the live person in front of the camera.

1

The user captures an image of the ID photo from the ID document (e.g. passport, driver’s license) using a camera or via Near Field Communication (NFC)

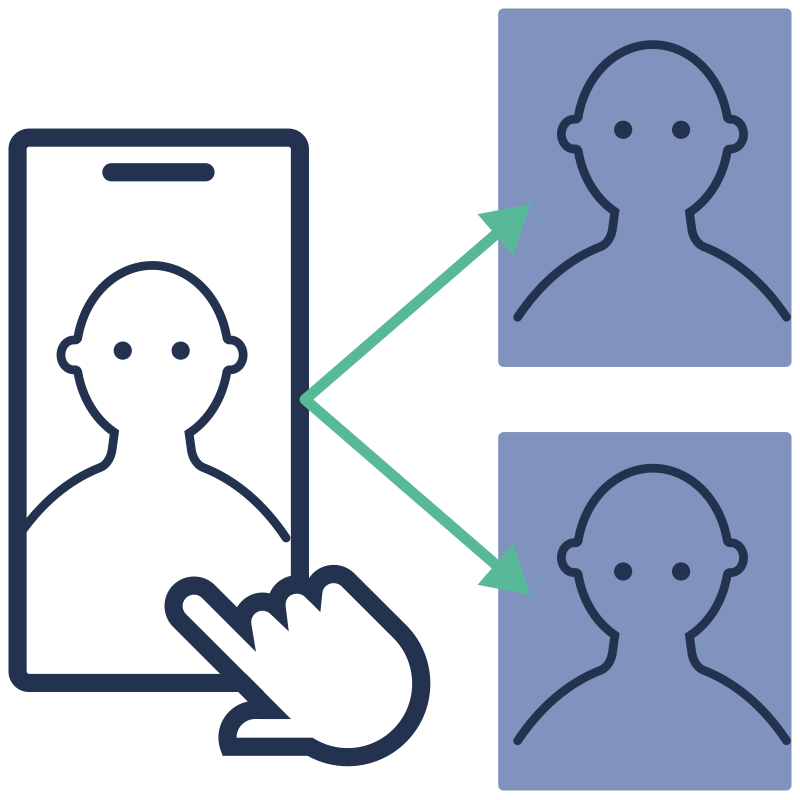

2

The user takes two selfies using a camera

3

BioID’s PhotoVerify verifies (1) the selfies were captured from a live person and (2) the ID photo and the selfies are from the same person

The biometric KYC/AML process is entering a new era of 24/7 self-service

In this digital world, all online services must be available 24/7 with high assurance levels of user authenticity at all times.

As identity fraud is by far the highest risk of all, rigorous identity validation practice is now being followed by all kinds of industries, not just for KYC/AML or onboarding purposes but also throughout the whole identity lifecycle, e.g. for account recovery, password reset, user attribute changes, etc.

BioID’s PhotoVerify is now the synonym for ID ownership validation supporting real-time eKYC implementations worldwide.

It also makes unattended high-security online services possible with tremendous savings in both time and cost.

More Use Cases

User authentication and user presence detection for remote work ensuring session integrity allowing authorized access only.

BWS offers match-on-server face login for online and mobile services enabling omnichannel services.

Secure and convenient physical and logical access control enabling an unified multifactor user authentication across different platforms.

“Face-to-face” registration and strong user authentication enabling eIDAS compliant digital signatures.

Made in Germany

since 1998

Originating from the research institute Fraunhofer IIS in 1998, BioID is a German biometrics company.

Our technology has a proven record since its inception and is trusted by countless enterprises, banks, and government organizations.